The 60/40 portfolio was once the gold standard for buy-and-hold investors. This simple formula offered the potential for strong annual returns with downside protection. However, in today’s market, there are several reasons why the 60/40 portfolio might no longer be the gold standard of portfolio management.

What is the 60/40 Portfolio?

In a 60/40 portfolio, 60% of the investments are allocated to stocks and 40% are allocated to low-risk bonds. In addition to its simplicity, a 60/40 portfolio offers investors diversification and lower volatility as bonds and stocks are negatively correlated, meaning the price of bonds rises when the price of equities falls. The 60/40 portfolio has historically delivered attractive returns. According to Vanguard, a 60/40 portfolio generated an average annual return of 8.8% between 1926 and 2019.

However, this changed in 2022, when the traditional 60/40 portfolio had its worst year since 2008. As a new macroeconomic environment characterized by higher inflation and interest rates emerged, allocating to alternative strategies within a diversified portfolio has gained appeal among individual investors.

Why It’s Time to Rethink The 60/40 Portfolio

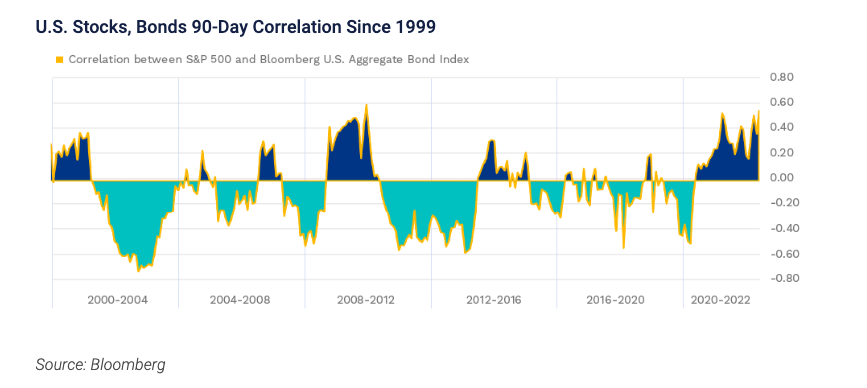

Over the last twenty years, the relationship between equities and bonds has largely been one of negative correlation, meaning that they move in opposite directions of each other. This has created a natural hedge on each position. It isn’t a given, though. The current environment of rising rates and higher inflation may be contributing to the switch to a positive correlation.

There are several factors contributing to investors rethinking the traditional 60/40 portfolio model.

Changing Dynamics in Treasury Yields. Recent changes in U.S. Treasury yields have significant implications for the traditional 60/40 model which heavily relies on the fixed-income component for stability and income. As U.S. Treasury yields fluctuate, bonds experience shifts in value, impacting their effectiveness as a diversification tool against equity market volatility. With yields trending upwards, bond prices have been under pressure, leading to potential capital losses for bondholders. Moreover, the inverse relationship between bond prices and yields means that as yields rise, the income generated from bonds may not keep pace with inflation, further eroding the real returns of the fixed-income portion.

Rising inflationary environment. Rising interest rates pose significant challenges to traditional 60/40 portfolio models. Induced by the easy money environment during the pandemic, a combination of macro factors, including rising production costs, strained global supply chains, and relaxed central bank policies, global economies have experienced a significant rise in inflation. Inflation is a dirty word for fixed-income investors as well as real returns. Investors relying on the 60/40 model may face diminished returns and increased portfolio risk in a rising interest rate environment.

The Quest for Diversification. Although stocks and bonds have been negatively correlated for over 20 years, recent macroeconomic dynamics have shown that the inverse relationship between these asset classes is not guaranteed. Derek Harris and Jared Woodard, portfolio strategists at Bank of America, said that the 60/40 portfolio is built on the premise that stocks and bonds are negatively correlated with bonds hedging against risks to growth and stocks hedging against inflation. But, they explain, “this assumption was only true over the past two decades and was mostly false over the prior 65 years. The big risk is that the correlation could flip.” Investors need to think beyond traditional stocks and bonds when building a diversified portfolio of investments.

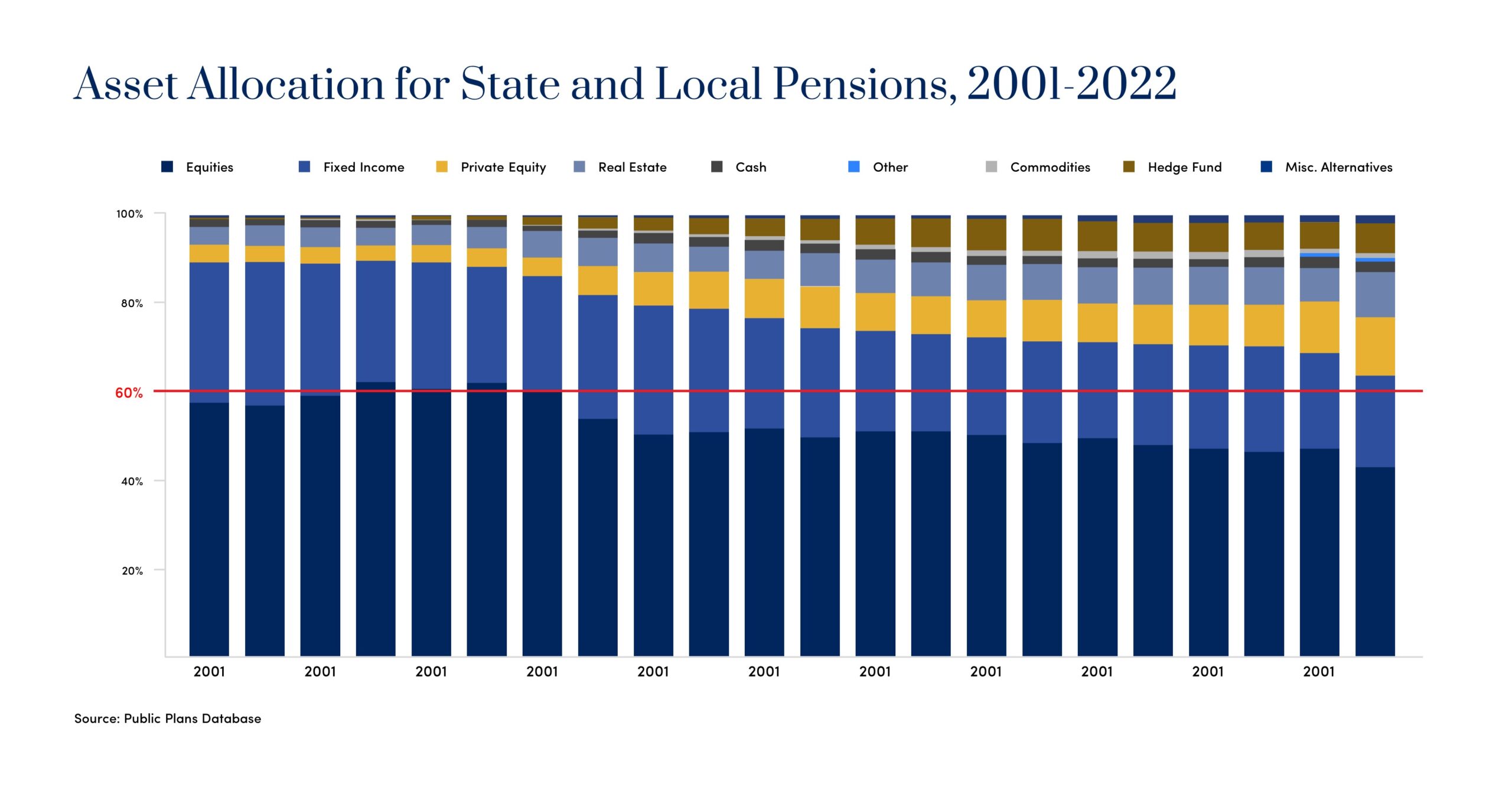

Using Alternative Investments to Help Improve the Risk-Adjusted Returns of a 60/40 Portfolio

For investors aiming to improve the risk-adjusted returns of a 60/40 portfolio, diversifying across alternative strategies is an approach that has merit. Besides return potential, alternative assets are generally considered effective diversifiers because they are less correlated to other assets. Alternative investments have continued to attract increased allocation from pension funds. According to UBS Wealth Management, pension funds increased their allocations to alternatives to 34% in 2022 from 9% in 2001, and 80% of public pension plans had at least 20% of their assets in alternatives.

Investors are increasingly looking outside of traditional fixed income into private credit. The asset class comprises loans made to companies by non-bank lenders. These companies generally have revenues between $10mm and $1 billion. Because of their size, these companies often cannot access the capital markets.

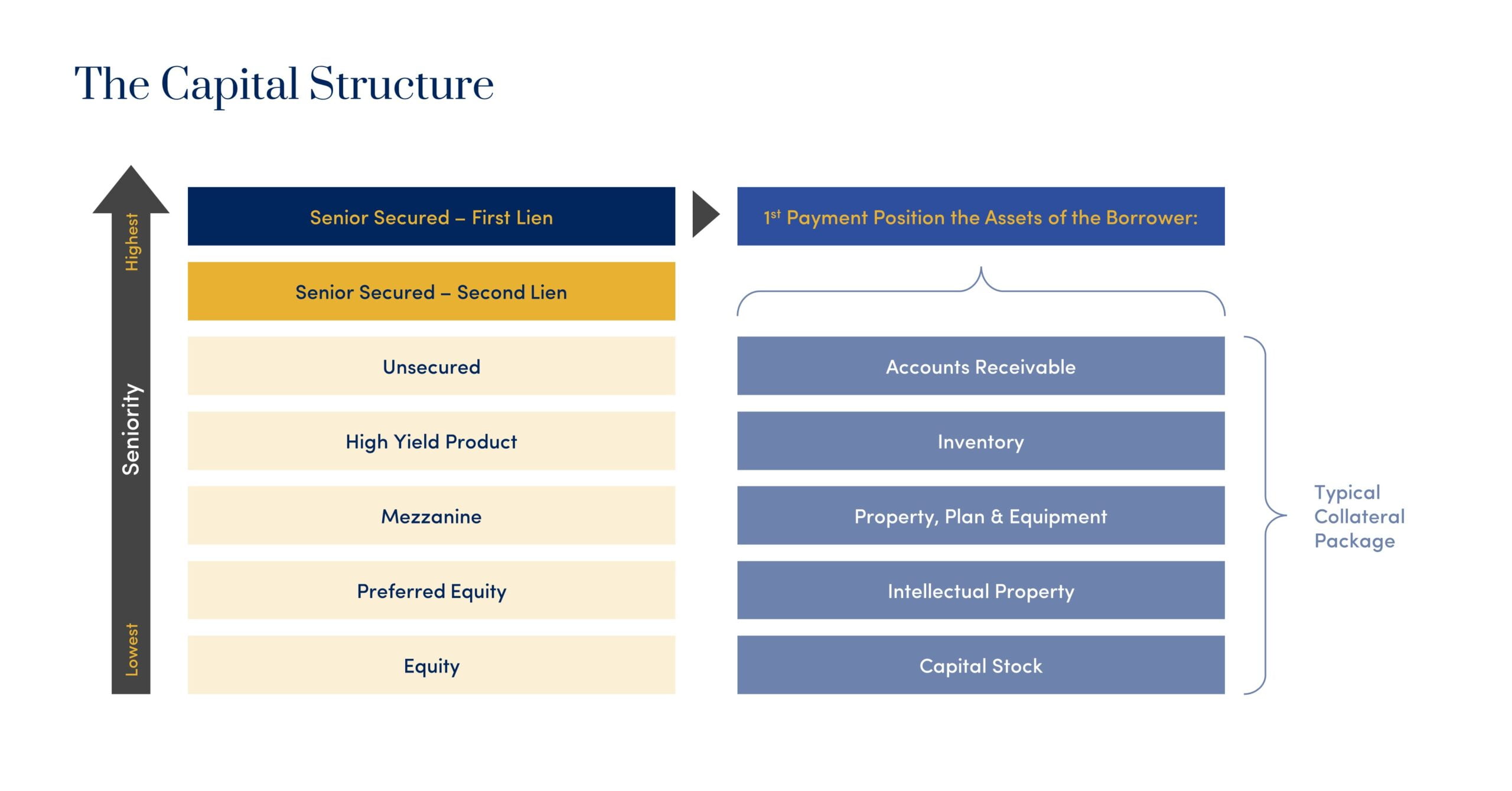

The non-bank lenders are generally institutional asset managers or specialty finance funds such as BDCs with proven expertise in originating these types of loans. They research the market, the companies, and the financial prospects of the sector, perform extensive due diligence, and are experts in structuring loans. These loans often have floating rates so they can mitigate interest rate risk and are typically senior in the company’s capital structure.

Investors are increasingly looking outside of traditional fixed income into private credit. The asset class comprises loans made to companies by non-bank lenders. These companies generally have revenues between $10mm and $1 billion. Because of their size, these companies often cannot access the capital markets.

The non-bank lenders are generally institutional asset managers or specialty finance funds such as BDCs with proven expertise in originating these types of loans. They research the market, the companies, and the financial prospects of the sector, perform extensive due diligence, and are experts in structuring loans. These loans often have floating rates so they can mitigate interest rate risk and are typically senior in the company’s capital structure.

A New Paradigm

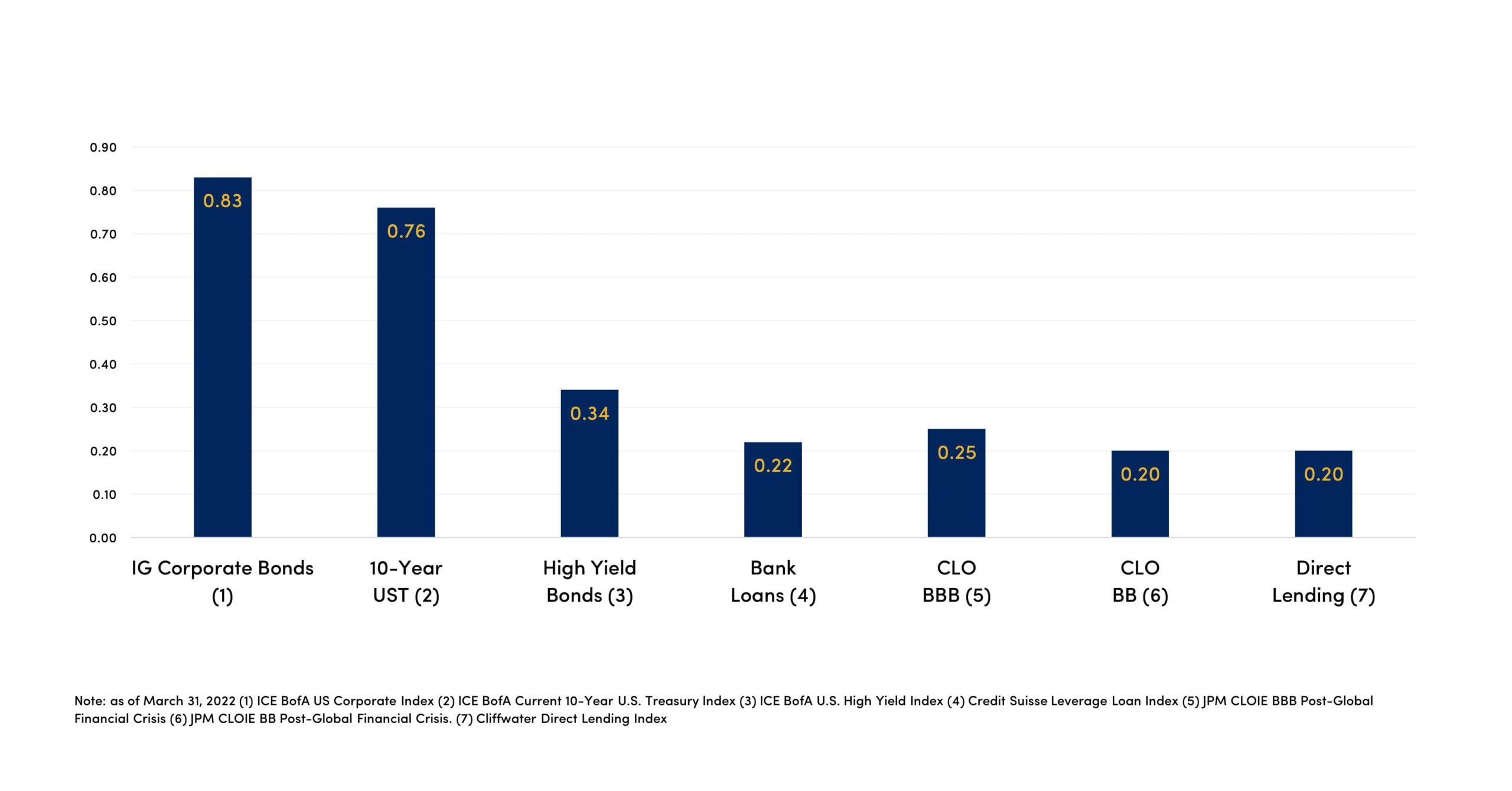

With traditional fixed income struggling and remaining positively correlated to the equity markets, the potential for portfolio volatility has increased. A look at how different income asset classes correlate to the Bloomberg Global Aggregate Bond Index provides some insight.

Individual investors are increasingly incorporating alternatives into their portfolios as traditional fixed-income investments remain under pressure. But even beyond enhanced yield, the asset class has other features that can help to create a modern diversified portfolio. Reach out to [email protected] to discuss opportunities and challenges in today’s private credit markets.