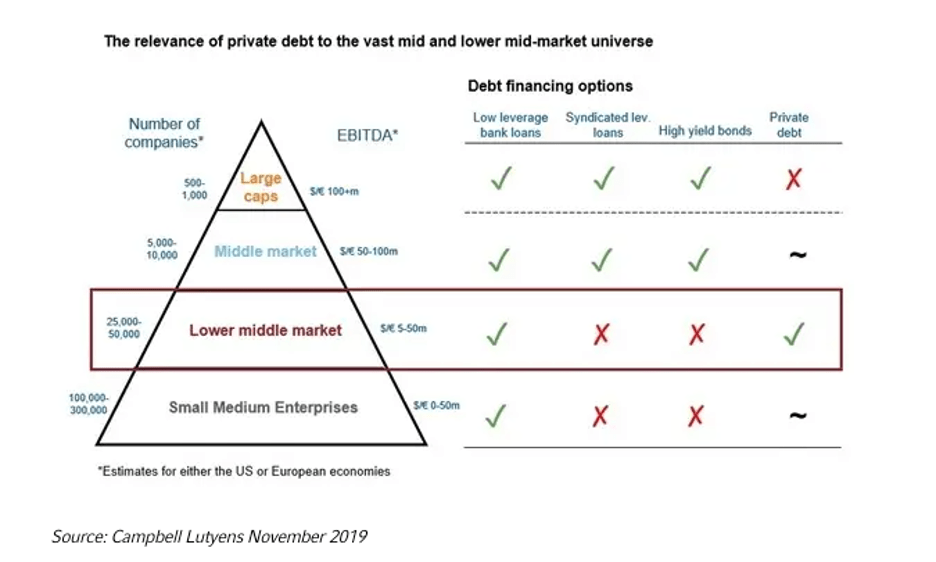

Securing funding for small to mid-sized businesses (SMEs) in the U.S. looks a lot different than it used to. Traditionally, these businesses had two options: attracting investors or obtaining a traditional loan from a bank. The lending landscape has shifted dramatically over the past decade, driven by various factors including stricter banking regulations, the lingering effects of COVID-19, and rising inflation. These changes have propelled private credit to the forefront as an alternative capital source for businesses.

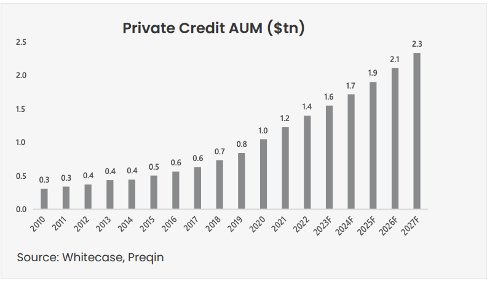

Private credit are loans provided by non-banking institutions to businesses. Over the past decade, the private credit sector experienced explosive growth, with assets increasing from $400B to $1T. Current macroeconomic conditions marked by rising interest rates and inflation, have further fueled the popularity of the asset class. Compared to traditional banks, private credit offers speed and efficiency, features which are appealing to borrowers. While banks are constrained by regulatory guidelines, private credit lenders can offer customizable lending products tailored to individual business needs. This flexibility is particularly appealing in times of financial strain, as companies seek tailored loan solutions.

The appeal of private credit also lies in the relationship-driven approach. Lenders collaborate closely with borrowers, aiming to create circumstances conducive to business growth and success. Moreover, the market provides innovative financing solutions for underserved sectors such as real estate and infrastructure. By understanding the unique needs of each market, lenders have gained the trust and appreciation of the borrowers they serve.

Small and mid-sized businesses are widely recognized as the backbone of economies, requiring capital to operate and expand. With banks becoming less accessible, these businesses have increasingly turned to private credit sources. Operating in a $1.6T industry, private credit funds, private equity firms, and institutional investors offer a variety of flexible lending strategies to meet the diverse needs of businesses.

Despite potentially higher costs, borrowers are willing to pay for the simplified and customized lending process offered by private credit. Many lenders view themselves as partners with the borrower, aligning their business models with the success of the companies they fund. This collaborative approach fosters a supportive environment for business growth.

Data suggests that the market for private credit is likely to continue growing, fueled by flexibility and innovation. As long as lenders maintain their focus on borrower relationships and continue offering tailored financing solutions, private credit will remain a vital source of funding for SMEs, gaining market share from traditional banks along the way.